Municipal AssessorsOffices

Functional Statement

Mandate:

The Office of the Municipal Assessor is mandated to conduct appraisal and assessment operations of existing real properties within the municipality which shall be accurately recorded for data gathering, documentation and retrieval with strict compliance of the provisions and regulations contained in the R.A. 7160 known as the “Local Government Code of 1991”.

Vision:

The office envisions to be always fair in the appraisal and assessment of the real properties, upholds the highest standards in providing quality service to the taxpayers and maintains an excellent employee – client relationship by adopting the principles of professionalism.

Mission:

To commit maximum efficiency in appraisal and assessment, ensure fair and realistic valuation of real property taxation, provide excellent customer service and implement innovative changes in systems, policies and procedures provided by law in order to generate sustainable revenues for realty taxes with minimal cost to the Local Government Unit.

Appraisal and Assessment Division

This division is responsible for real property appraisal and assessment operations with strict compliance of the standard guidelines prescribed by Department of Finance – BLGF and in conformity with the standards prescribed by the Secretary of Finance and Sangguiniang Panlalawigan. It is not limited with the latter as it covers a wide scope of appraisal and assessment works of land, building, machineries and other land improvements. Further, it will be working under the direct supervision of the Municipal Assessor and performs other duties and functions as may be prescribed by law and ordinance.

Land Appraisal & Assessment Section

Primary responsible for all real property field appraisal and assessments for Lands only by strictly observing the Schedule of Fair Market Values pursuant to R.A. No. 7160 with the application of the appropriate assessment levels prescribed by the Sanggunian Panlalawigan concerned. It shall prepare Tax Declarations, keep track of the records involved, generate reports, observe standard guidelines, monitor team performance and work hand in hand with the Tax Mapping Division/Section should there be a need to for smooth work flow within the organization.

Building Appraisal & Assessment Section

Primary responsible for all real property field appraisal and assessments for Buildings only by strictly observing the Schedule of Fair Market Values pursuant to R.A. No. 7160 with the application of the appropriate assessment levels prescribed by the Sanggunian Panlalawigan concerned. It shall prepare Tax Declarations, keep track of the records involved, generate reports, observe standard guidelines, monitor team performance and work hand in hand with the Tax Mapping Division/Section should there be a need to for smooth work flow within the organization.

Machineries Appraisal & Assessment Section

Primary responsible for all real property field appraisal and assessments for Machineries only by strictly observing the Schedule of Fair Market Values pursuant to R.A. No. 7160 with the application of the appropriate assessment levels prescribed by the Sangguniang Panlalawigan concerned. It shall prepare Tax Declarations, keep track of the records involved, generate reports, observe standard guidelines, monitor team performance and work hand in hand with the Tax Mapping Division/Section should there be a need to for smooth work flow within the organization.

Tax Mapping Operations Division

This division provides a permanent link between real properties and office records as it is primary responsible for tax mapping operations within the municipality. Tax mapping updates the status of real properties by means of actual field inspections. These updated records will serve as the basis for real property appraisal and assessment. It also generates reports, provide tax mapping services to tax payers, coordinate with the Appraisal and Assessment Division and will be working under the direct supervision of the Municipal Assessor and performs other duties and functions as may be prescribed by law and ordinance.

Tax Mapping Section

This section designs the tax map within the municipality and ensures no duplication of property index number. Determined the kind of transaction whether new, transfer, consolidation or segregation. It also analyzes map subject for property assessment and coordinate with other department/agencies relative to real property tax map.

Records, Plans and Maps Section

This section is entrusted to keep the plans and maps in secured location. These are important records that supply information about real property location, ownership and status relevant for tax mapping and field appraisal and assessment operations. Prepare, install and maintain a system of tax mapping showing graphically all properties subject to assessment in the municipality and gather all necessary data concerning the same with sum total of all the land area of the municipality.

Real Property Inventory Section

This section performs the administrative works for the Tax Mapping Operations Division. It is primarily responsible for real property inventory and records keeping of this division.

Administrative and Information Technology Division

This division takes responsibilities in maintenance and updates of all records keeping and report generations for internal and external communication related to administrative and real property assessment in both hard and computer files. Its key function includes but not limited to the overall safekeeping of physical and computer – based records keeping as prescribed by Department of Finance – BLGF. It will also cater to tax payers’ requests such as preparation of certificates related to real properties and generate reports. Further, it will be working under the direct supervision of the Municipal Assessor and performs other duties and functions as may be prescribed by law and ordinance.

Records Management Section

It shall keep all the records that are deemed important within the Municipal Assessor’s Office. Strict compliance with Records Management Standards as prescribed by Department of Finance – BLGF will be observed in order to properly compile documents for efficient data retrieval with an aid of computer program and by physical filing, bookbinding and safe keeping of all assessment records related documents for future references. Prepares and issues Assessors Certifications. Prepares Notice of Cancellation of assessment for demolished properties and duplications of entry.

Statistics Assessment Section

This section is in – charge in eliminating from the assessment roll of taxable properties such properties which have been destroyed or have suffered permanent loss of value by reason of storm, flood, fire or other calamity; or being exempt properties that have been improperly included in the same. It shall also annotate in the Field Assessment Appraisal Sheet (FAAS) and in the Tax Declaration any encumbrances or adverse claim over the subject property. In-charge for BLGF-SRE Form No. 3 or Quarterly Report on Real Property Assessment and prepares and maintains Records of Assessment.

Administrative Section

Generally responsible for assisting the Municipal Assessor to formulate and implement plans, programs, activities, office policies, guidelines, internal and external communication. Provide administrative support to the office which includes office management, clerical works, rendering staff support. Organize filling system and maintain records of all office important documents such as court order, office correspondence, memorandum/ circulars/ presidential decrees/ implementing guidelines, memorandum receipts, radio message/ telegrams, minutes/ resolutions of various councils and committee, vouchers and its supporting documents.

Information Technology Section

Information technology is responsible in building communications networks for the department, safeguarding data and information, creating and administering databases, helping employees troubleshoot problems with their computers or mobile devices, or doing a range of other work to ensure the efficiency and security of business information.

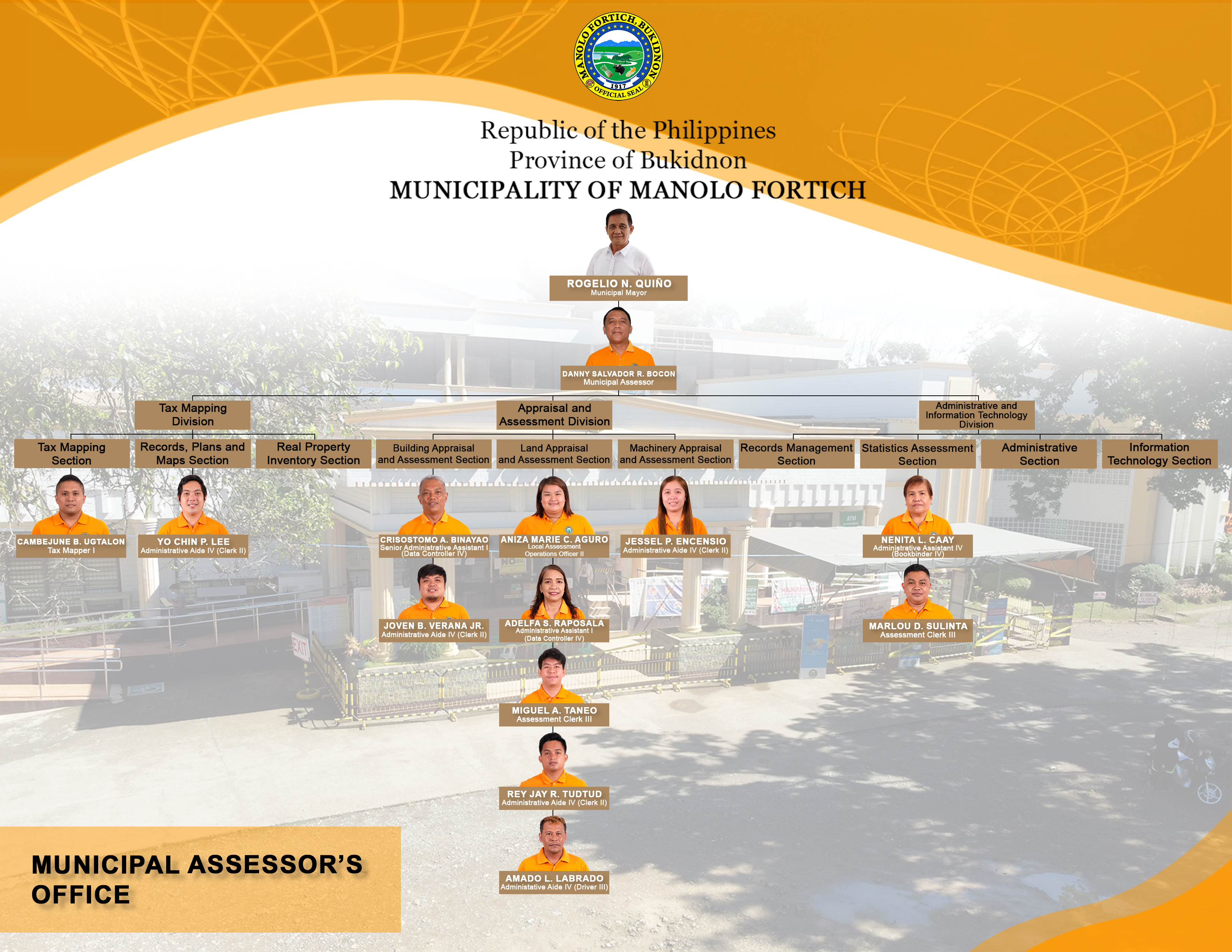

Organizational Structure